|

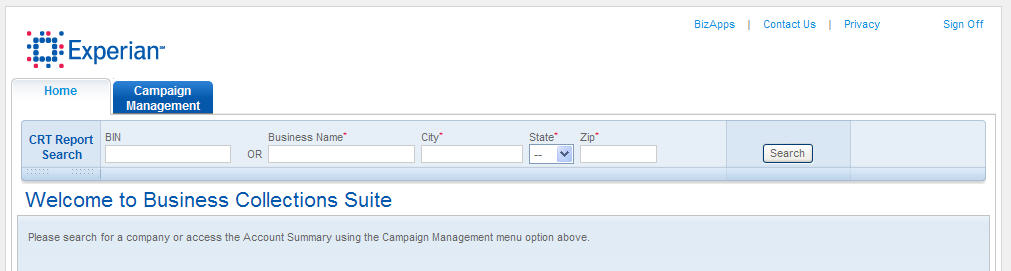

What is Business Collections Suite?

Business Collections Suite is Experian’s commercial collections tool that provides one-stop access to many of the functions required by collections departments. By providing access to Experian’s rich business database, Business Collections Suite allows you to query your accounts to find alternate contact information on debtors and identify your customers’ ability to pay.

Do I have to contribute my data to use Business Collections Suite?

Sending collections letters requires data contribution. The contributed accounts are put into a database for your use and to help generate results reports.

However, if you are interested in researching debtors only, this portion of the system does not require data contribution.

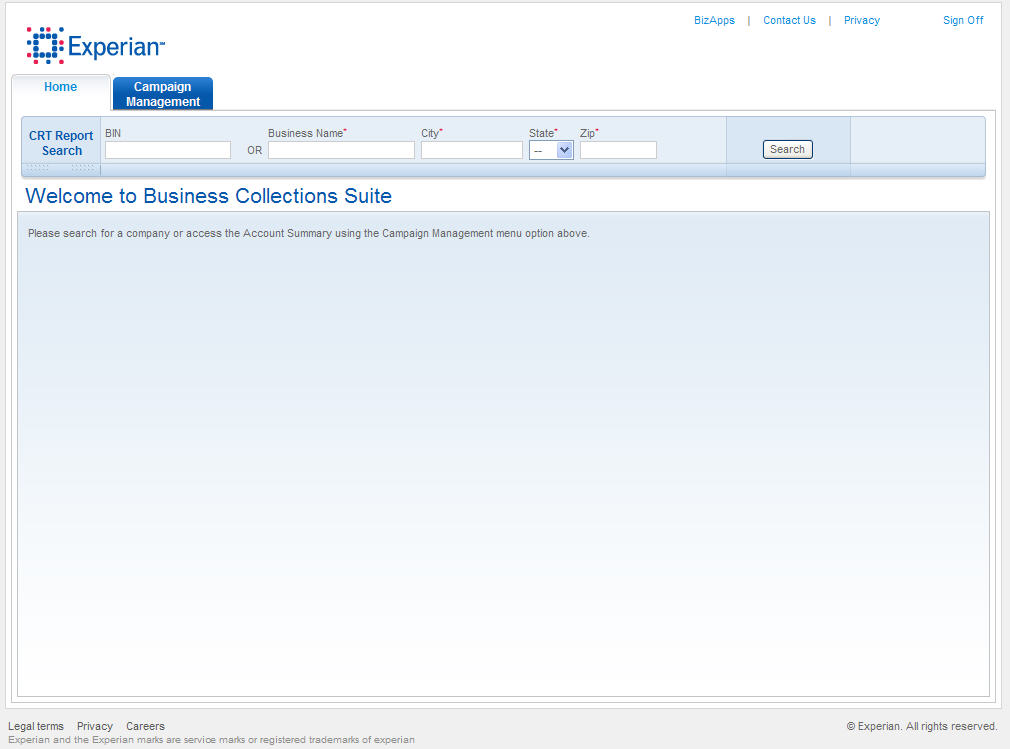

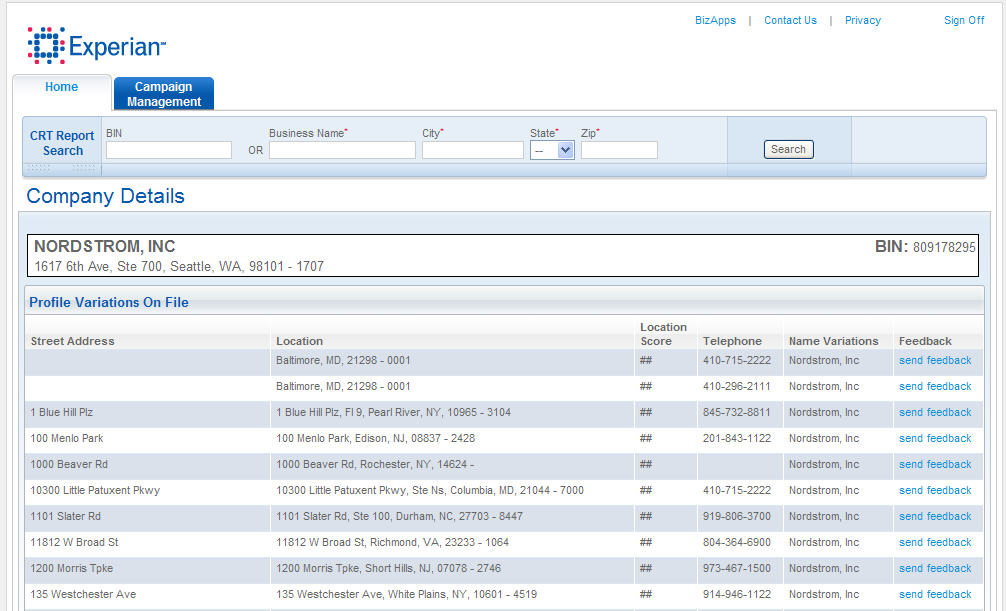

How do I research customers?

The research portion of Business Collections Suite lets you search for accounts by Business Identification Number (BIN) or a combination of business name, city, state and ZIP CodeTM. The reports you receive display alternate addresses and contact telephone numbers as well a 90-day cross-trade payment summary, which plots how the business is paying creditors.

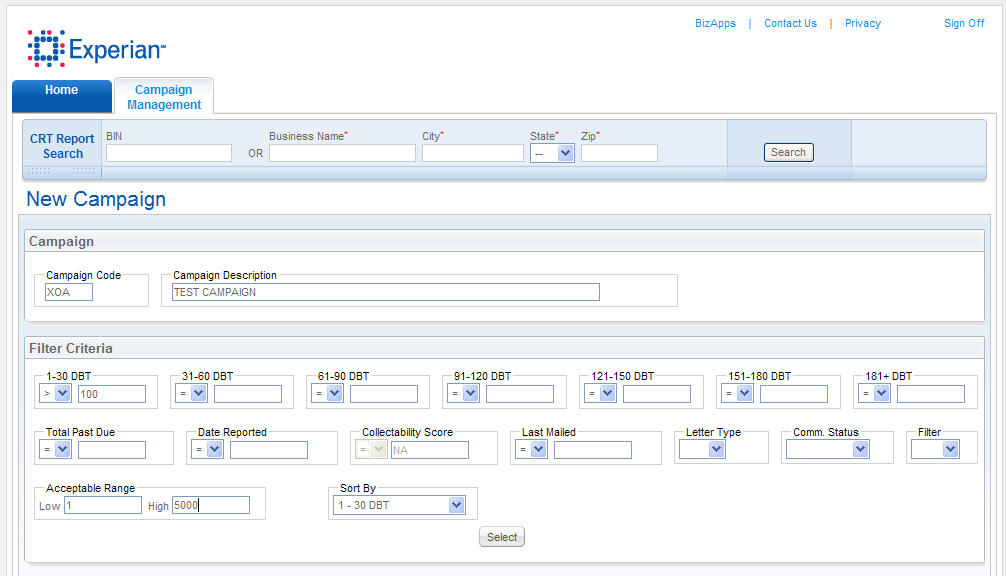

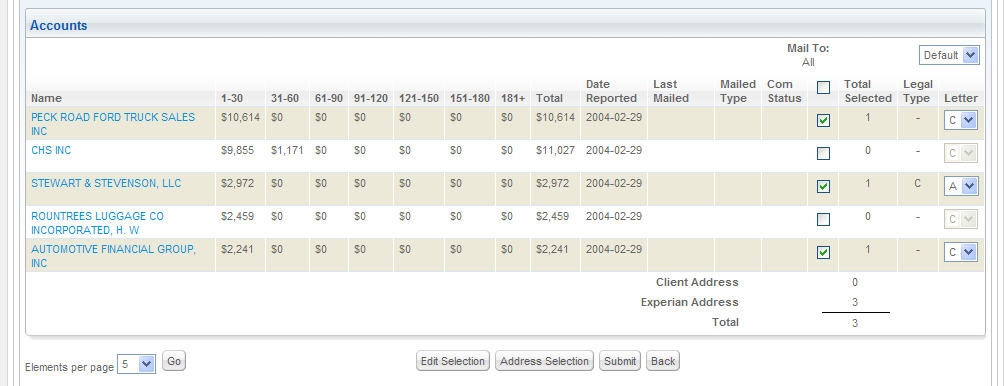

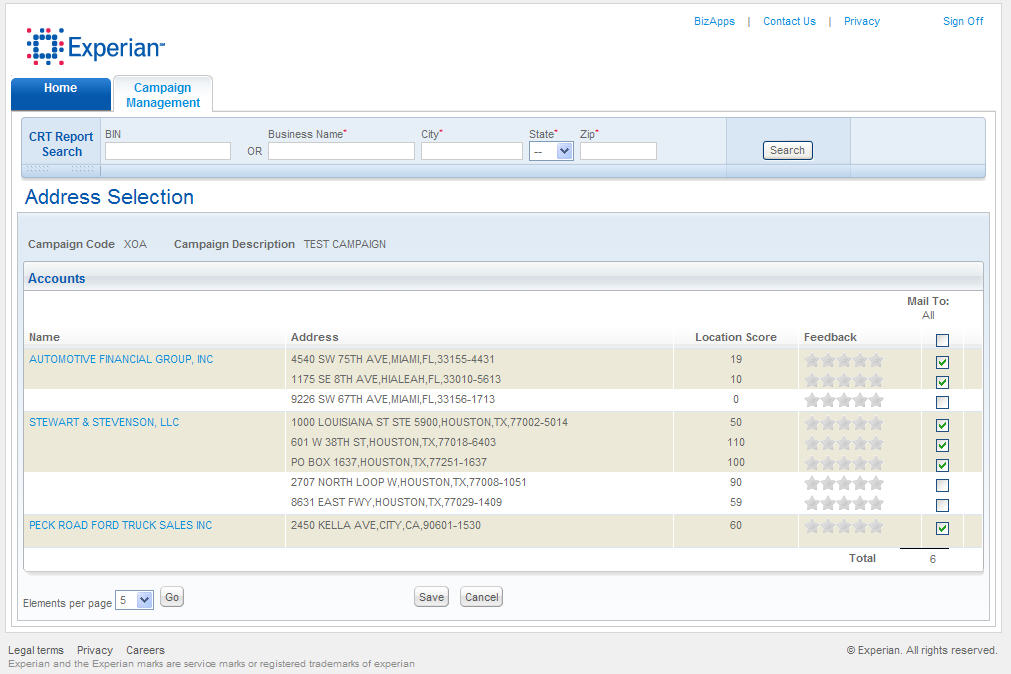

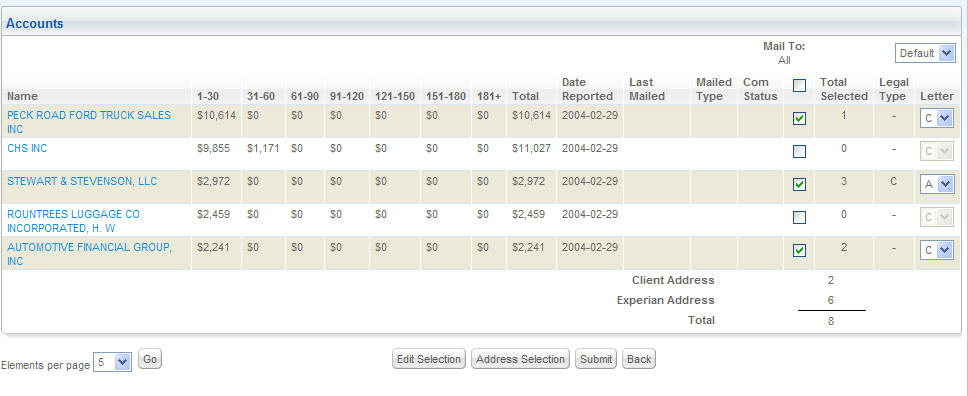

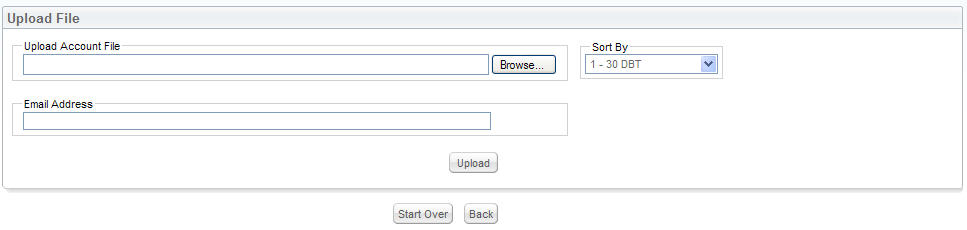

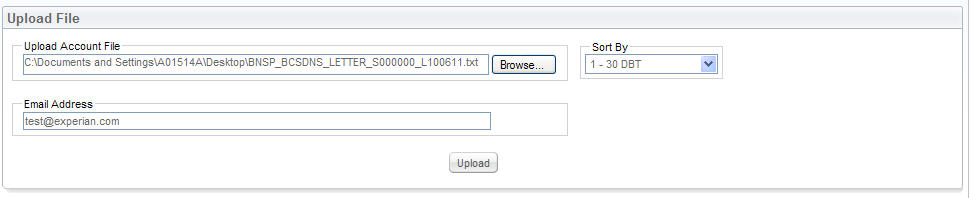

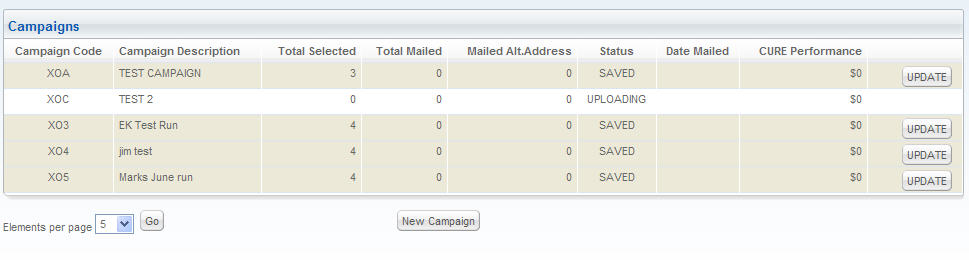

How do the letter campaigns work?

The letter campaigns leverage Experian’s Delinquency Notification ServiceSM to promote payment by debtors. Within Business Collections Suite, you can set up campaigns, query your portfolio to identify accounts for mailing and execute a campaign where letters are sent within 48 hours.

The letters are Experian-branded, but the contact and payment information is yours. Users have found that leveraging the Experian brand brings stronger collection results.

Why are some letter types not available for some of my accounts?

Our system matches the legal entity designation to the available letter types. The following table summarizes what letter types are available based on legal entity:

Letter type:

- Letter A: “Friendly” letter. Minimal severe language. Best for accounts that are 1 to 60 days beyond terms (DBT).

- Letter B: “Severely worded” letter. Severe language. Best for accounts that are 60 or more DBT.

- Letter C: “Just the facts” letter. Contains no severe language. Best for sole proprietorships and unknown corporate status.

Available letter by legal entity:

|

Legal entity

|

Available letters

|

|

Sole proprietor

|

C

|

|

Partnership

|

A, B, C

|

|

Corporation

|

A, B, C

|

Does the system tell me how successful my collections letter campaigns were in generating revenue?

Yes. However, your internal systems are the best guide for measuring success. Our system uses an algorithm based on the data you report to us from month to month, but since your company receives the checks, you should cross-reference what is in Business Collections Suite with your internal system. As part of the service, you also will receive National Change of Address (NCOA®) feedback to let you know if the letters are reaching their intended destination

|